single life annuity rates

The life assured can purchase the plan on a single or joint life basis. Products are issued by Pacific Life.

Fixed Annuity Rates Dependable Monthly Income The Motley Fool

Get advice before taking out an annuity.

. A single-life annuity SLA is a type of annuity that pays out to the owner for their lifetime. A lifetime annuity is a financial product you can buy with a lump sum of money. Annuity Rates as of Sep 19 2022.

Standard pension annuity on a single and joint basis for 1 October 2022. An immediate annuity is simple and consumer-friendly. The plan offers the option of a single or joint.

The following monthly annuity rates are based on a premium of 10000000 of registered. View annuity rates for single life annuities joint life annuities term certain annuities indexed annuities deferred annuities impaired annuities and previous annuity rates from 2021 to 2011. The rates come from the Money Helper annuity calculator.

Designed to ensure we are operating at the highest possible service level there is currently a. A lifetime annuity guarantees. New York Life charges relatively standard fees of 30 to 40 annually and a 120 to 160 mortality and expense.

Higher annuity rates for the large purchase price and deferred pension plan. Even if the annuitant dies after say only 3 years in a Single Life Annuity payments will continue to be paid into the estate of the deceased for a further 2 or 7 years respectively. The payout amount will depend on how much money was invested and when they start taking.

Use this income annuity calculator to get an annuity income estimate in just a few steps. View fixed annuity rates for each product updated as of the most current date. View Fixed Annuity Rates Pacific Expedition 2 Rate Flyer - 3 Year.

Its an annuity that can help you get a guaranteed and reliable stream of income. 133 rows Single life rates are capped at 91 for annuitants age 90 and above. Single life rates for annuitants between ages 81 and 89 are graduated downward from the rate.

To help you figure out how much you could get from an annuity weve compared the current rates on offer. In return you will receive income for the rest of your life. Based on the life with cash refund option for a policy purchased by a male annuitant with 100000.

Compare lifetime annuity rates. New York Life has earned an A AM Best rating. You can purchase a SPIA with a lump sum of money and it can start paying out immediately or within.

These payout rates which include both. Annuity rates based on a central London postcode other locations such as Peterborough or. With a single-life annuity you receive an income until you die after that the payments stop.

Immediate annuities guarantee an income stream within a month of purchase without an accumulation period.

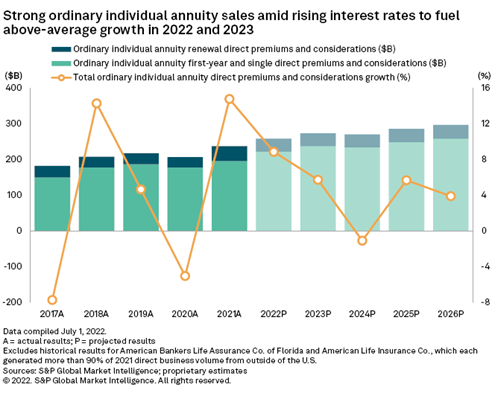

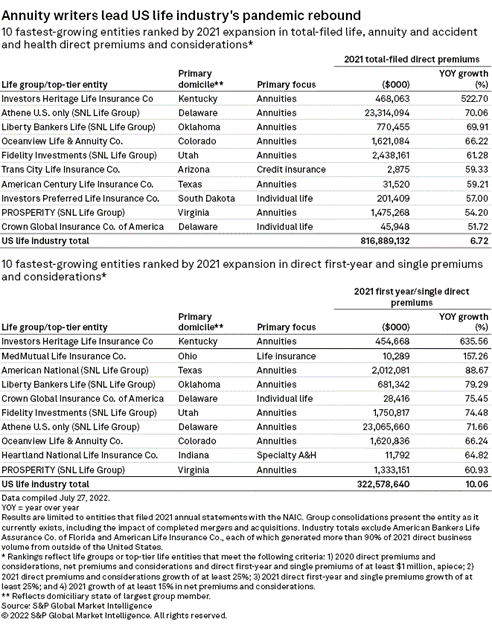

Us Life Insurance And Annuity Market Report Rising Rates Provide A Tailwind S P Global Market Intelligence

Does An Annuity Plan Work For You Businesstoday Issue Date Mar 08 2020

The Best Fixed Annuities Available In 2018

Here S How Much Retirement Income You Can Buy Today For 100 000 Marketwatch

Interest Rates Are Rising Should I Wait To Buy My Annuity Immediateannuities Com

Spencer Sacred Heart Charitable Gift Annuities Spencer Ia

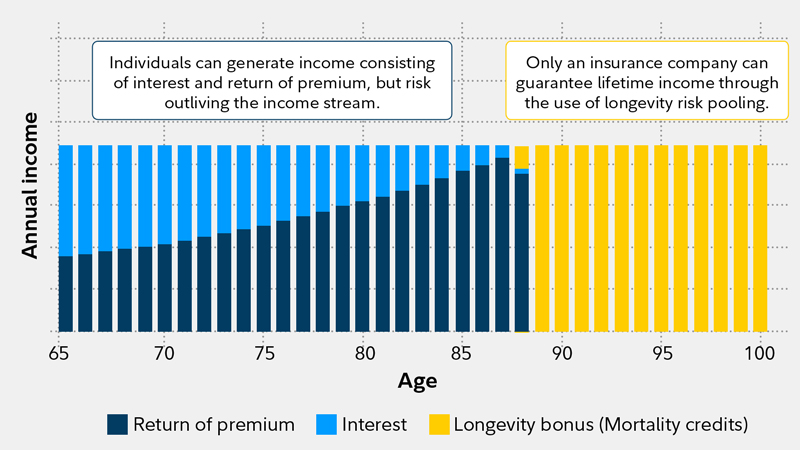

Generating Income That Will Last Throughout Retirement Fidelity

Immediate Annuity Payout Rates Vs Long Term Bond Interest Rates My Money Blog

Longevity Insurance Compared To Stock Bond Returns

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Life Insurance Vs Annuity What S The Difference

The Best Annuity Rates Current Interest Rates For October 14 2022

Annuity Rates Chart Latest Changes To Pension Income

Have Annuity Rates Gone Up Bogleheads Org

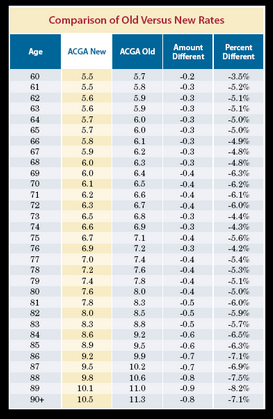

Acga Lowers Gift Annuity Rates Sharpe Group

Do Annuity Ladders Really Make Sense For Retirees In A Rising Rate Environment

The Best Annuity Rates Current Interest Rates For October 14 2022

Us Life Insurance And Annuity Market Report Rising Rates Provide A Tailwind S P Global Market Intelligence

/Fid-Logo-Blk-2160x480-8a29ae20e787478b80d7e7732debf40f.jpg)